Cloud Based Legal Billing and Accounting Software

All-in-One Cloud Accounting and Billing for Law Firms

In today’s legal landscape, law firms need more than just spreadsheets and generic accounting systems. You need a solution that understands the specific financial and compliance obligations of a legal practice — one that supports accurate billing, client accounting, disbursement management, and real-time financial visibility.

Klyant offers a powerful, secure, and fully compliant cloud-based legal billing and accounting software platform — designed exclusively for law firms and solicitors across the UK and Ireland. With Klyant, firms can manage time entries, generate invoices, manage client funds, handle VAT submissions, and stay compliant with SRA and Law Society rules — all from one centralised, cloud-based solution.

What is important about being a Cloud Based Legal Billing and Accounting Software solution?

When a solution is cloud based, it means that the user has secure access to their data from wherever they are so long as they are connected to the internet. This means that when using a cloud based legal accounts solution like Klyant, our users can manage whatever they need to in terms of client billing, client and office accounting, run reports or whatever else they need to do — in real time, from wherever they are.

What is important about a legal specific accounts solution?

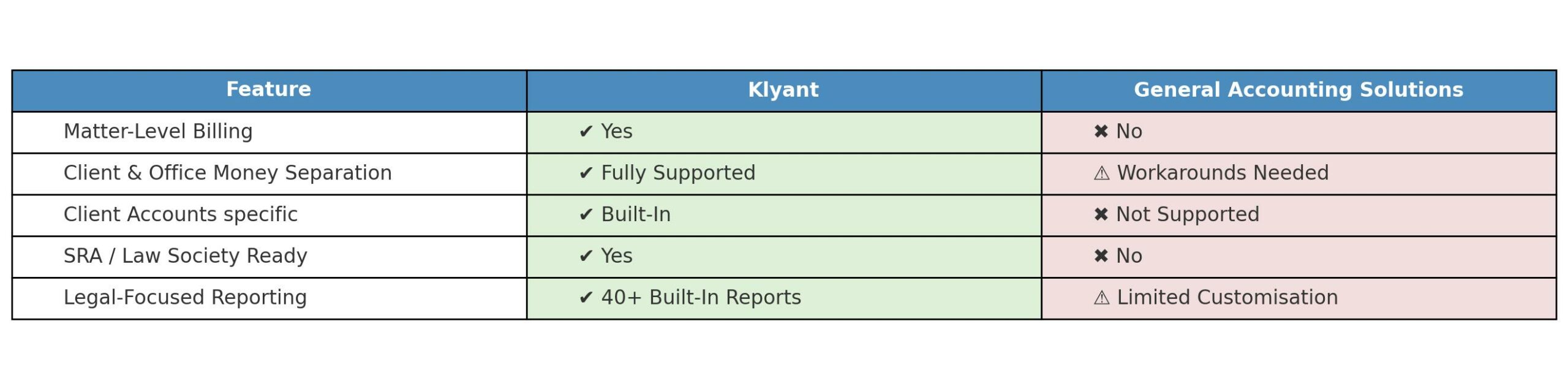

Unlike a general accounts solution like Xero, Sage or QuickBooks, legal-specific cloud platforms like Klyant are designed to:

- Support client and office money separation out of the box.

- Manage bank or linked outlays/disbursements and time recording

- Ensure compliance with SRA Accounts Rules and Law Society standards

- Provide matter-level accounting, billing, and reporting

Uses the terminology a law firm uses everyday and offers support for issues that only a law firm will face.

Why Law Firms are Switching to Klyant

Fully Integrated Billing and Accounting

Unlike many standalone solutions, Klyant provides a unified platform for both legal billing and firm-wide accounting — eliminating duplication, inconsistencies, and the need to juggle multiple systems.

Key capabilities include:

- Matter-based invoicing

- Fee earner time recording

- Outlay/Disbursement management

- Office side and client side separation

- Separate office and client Bank reconciliation

- VAT return submissions (MTD-compliant)

Comprehensive Legal Billing Functionality

- Time Recording – Record time entries against specific matters with ease, by fee earner

- Automated Invoice Generation – Pull together time entries and, disbursements automatically.

- Client Statements – Issue clear and professional client account statements on demand

Legal-Specific Accounting and Compliance

- Client Accounting – Manage client money with full transparency and compliance

- Client/Matter Reporting – View balances and transactions at the matter or client level

- Overdrawn and Dormant Balances Alerts – Automated alerts for SRA/LSI compliance

- SRA-Compliant Reconciliation Reports – Audit-ready reporting out of the box

- Chart of Accounts Customised for Legal Firms – Remove confusion and increase reporting relevance

Cloud-Based Flexibility Meets Enterprise-Grade Security

With Klyant, your law firm’s financial data is available securely, wherever and whenever you need it.

- No installation required – Just log in from your browser

- Automatic backups and updates – Stay current without IT support

- Multi-user access – Collaborate across departments, offices, or remotely

- Role-based permissions – Ensure the right people see the right data

- Secure client access (optional) – Share statements or invoices directly with clients

Real-Time Financial Intelligence

Klyant’s suite of reports gives you actionable insights into your firm’s financial performance.

View live data on:

- Aged debtors and fee recovery

- Matter Budgets

- Cost Centre functionality (optional)

- Client account balances

- Export reports as PDF or Excel with smart filters — perfect for monthly board packs, audits, or financial planning.

Designed for Legal Professionals

Klyant is used by a wide variety of legal roles:

- Managing Partners – to monitor performance and make strategic decisions

- CFOs and Finance Managers – to streamline month-end processes and compliance

- COFAs and Compliance Officers – to ensure SRA/LSI rules are followed

- Bookkeepers and Legal Secretaries – to simplify daily billing and reconciliation

- Fee Earners – to log time and review billing effortlessly

Whether you’re a solo solicitor, a growing practice, or a multi-office law firm, Klyant scales with your needs.

Key Benefits of Klyant’s Cloud Legal Billing & Accounting Platform

✅ Improve Billing Efficiency – Reduce time spent on manual invoices

✅ Increase Fee Recovery – Never miss billable time or disbursements

✅ Stay Compliant – Automated reporting and alerts for overdrawn or dormant balances

✅ Enable Remote Work – Secure access from any location

✅ Enhance Financial Visibility – Real-time legal-specific reports

✅ Simplify VAT Returns – Submit directly to HMRC (MTD-ready)

Start Today — Cloud-Based Billing & Accounting Built for Law Firms

Klyant combines modern cloud technology with deep legal accounting knowledge to give your firm an all-in-one solution that saves time, reduces risk, and boosts profitability.

- Is Klyant suitable for small and medium law firms?

Yes, Klyant is highly scalable and ideal for firms of all sizes, from solo practices to multi-location law firms.

- Does it support both UK and Irish regulatory frameworks?

Absolutely. Klyant supports SRA Accounts Rules (England & Wales), Law Society of Ireland and NI trust accounting, and Making Tax Digital (MTD) for VAT.

- How long does setup take?

Most firms are onboarded in under 2 weeks, including data migration and user training.