Legal Disbursement Management Software for Law Firms

Streamline Legal Disbursements and Stay Fully Compliant

Managing disbursements can be a time-consuming task for law firms. From tracking client-related expenses to ensuring accurate billing and compliance with regulatory frameworks, there’s little room for error. Klyant’s Legal Accounting solution simplifies the entire process — making it easier to record, categorise, recover, and report on disbursements accurately and efficiently.

Whether you’re a boutique law firm or a larger practice, Klyant provides a flexible, cloud-based solution built specifically for legal professionals who want to take control of their financial workflows.

What is Disbursement Management?

Disbursements in a legal context refer to expenses a law firm incurs on behalf of a client — such as court fees, expert reports or search fees. Effective disbursement management ensures these costs are:

- Properly recorded against the relevant matter

- Assigned to the correct income or VAT codes

- Seamlessly included in billing

- Traceable for audit and reporting purposes

Without the right tools in place, firms risk under-recovering costs, creating compliance risks, or wasting time on manual reconciliation.

Klyant's Legal Disbursement Management Software: Key Features

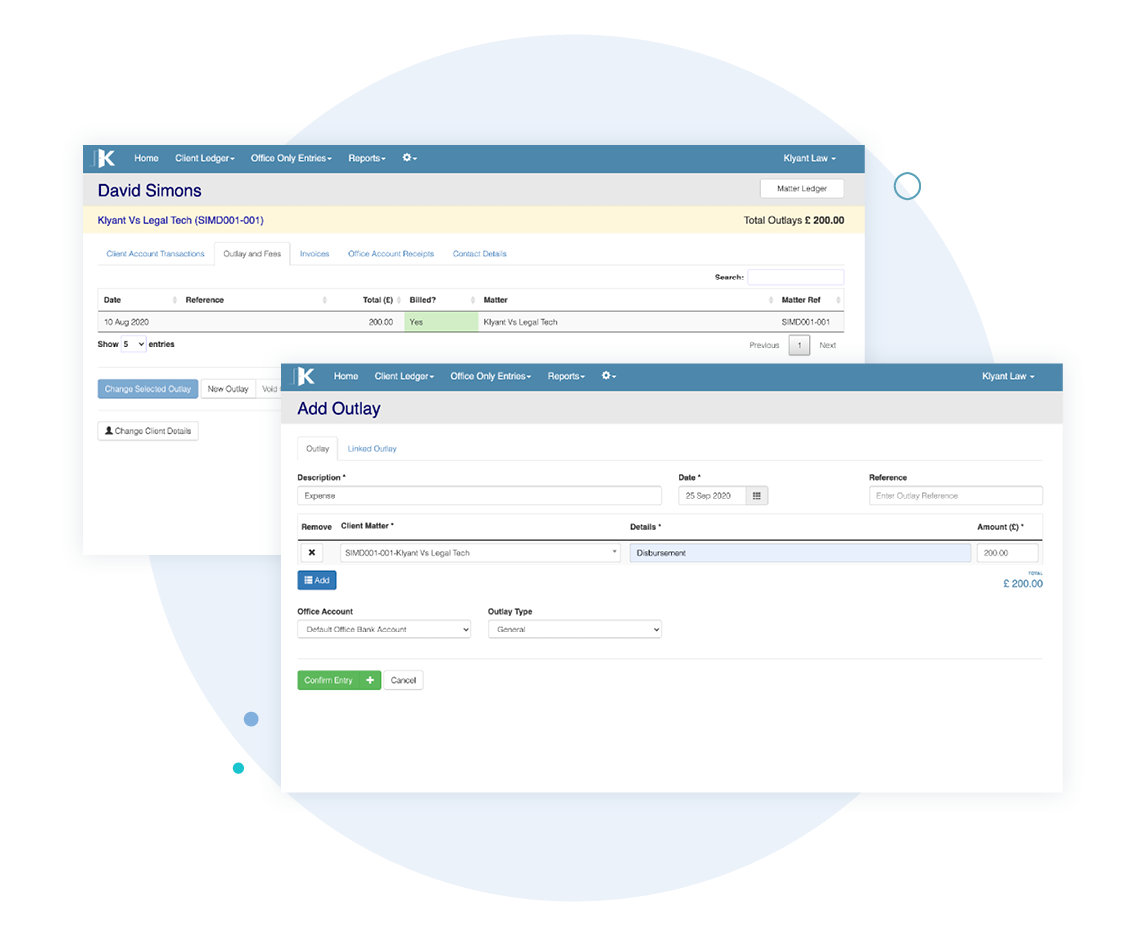

✅ Matter-Level Expense Tracking

Track every disbursement at the matter level, ensuring a complete financial picture for each client and case. Klyant links expenses directly to the relevant matter and fee earner for accurate reporting and recovery.

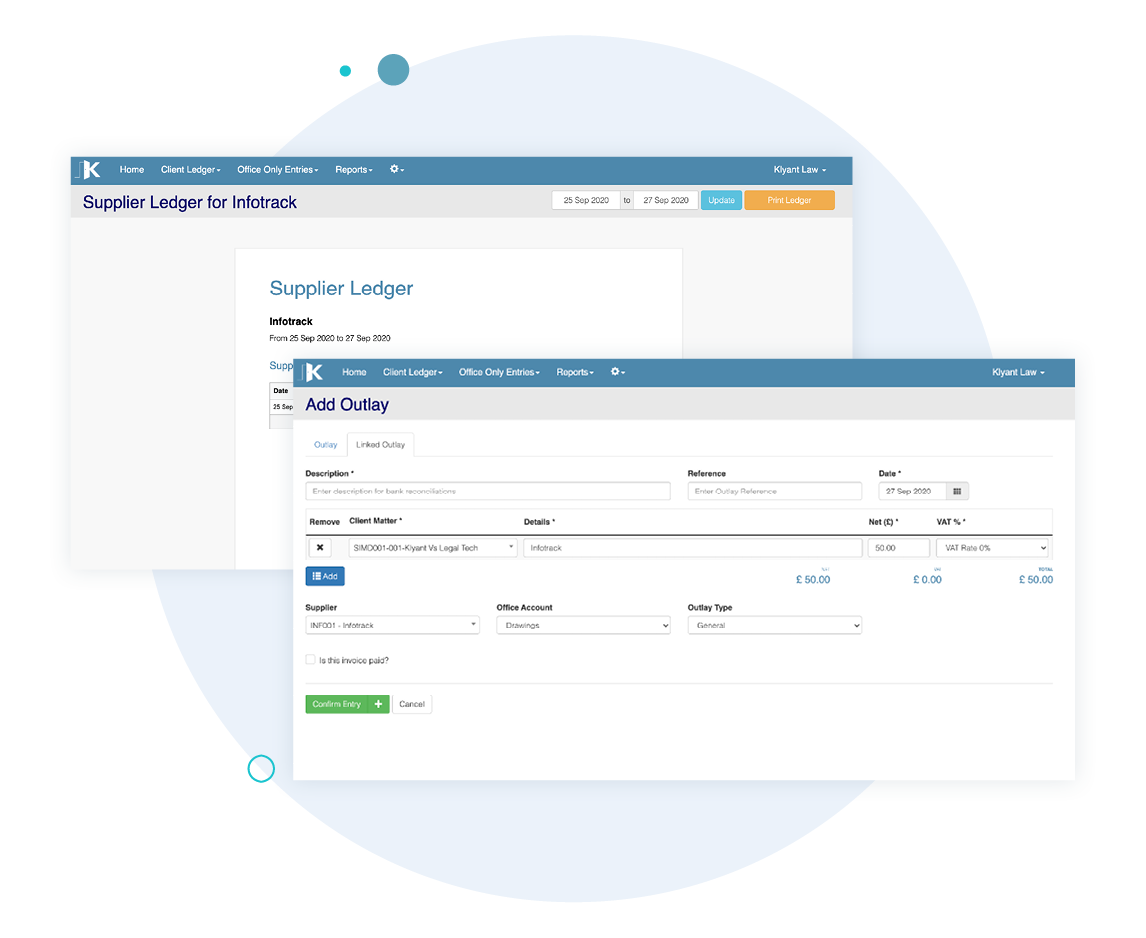

✅ Flexible Posting Options

Record disbursements directly from the matter itself with the option of linking directly to a supplier. Choose between VAT-inclusive or non-VAT disbursement types based on expense nature and jurisdictional requirements.

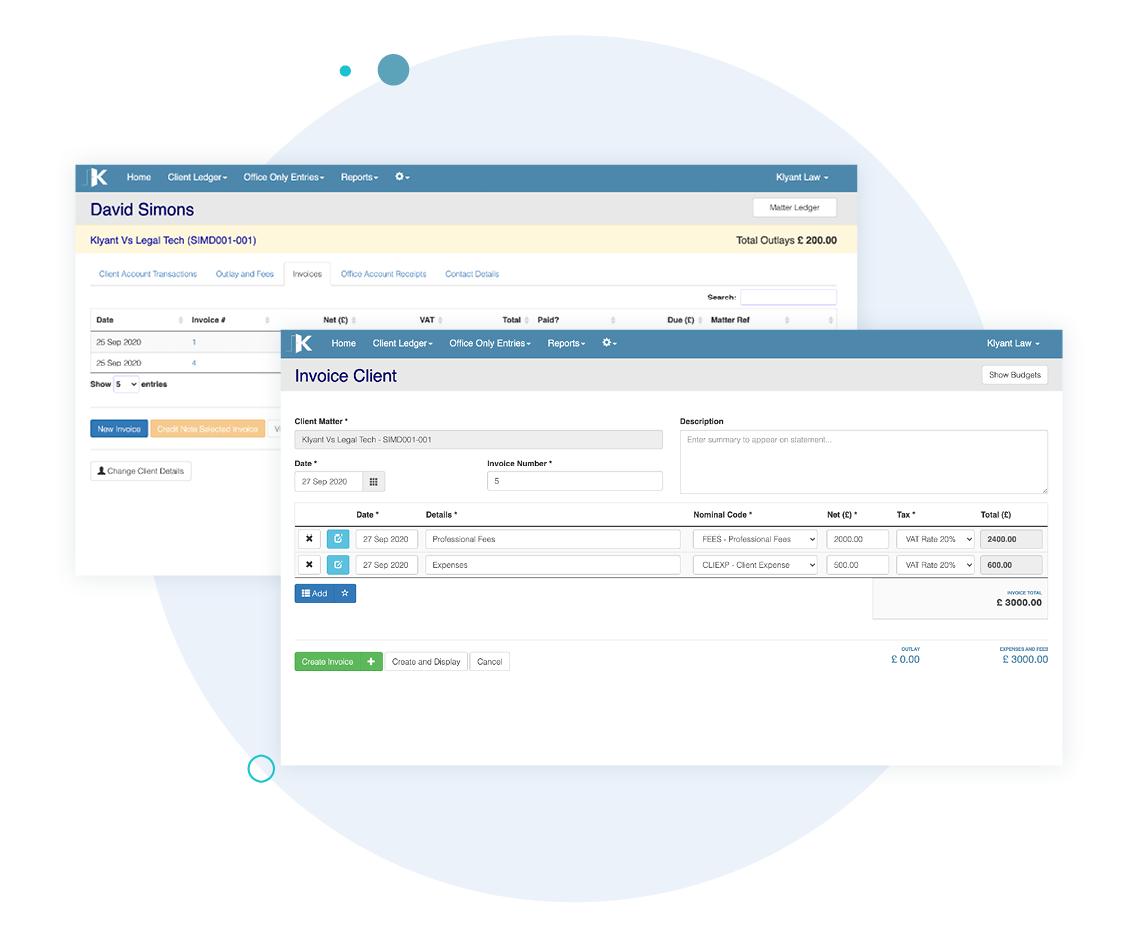

✅ Seamless Bill Integration

All recorded disbursements automatically appear during the billing process, eliminating the risk of missed charges. You retain full control over what appears on the bill and how it is presented.

✅ Configurable Expense Categories

Define and customise your disbursement categories to match your firm’s practices, making it easier to maintain consistency, control spend, and comply with accounting standards.

✅ Transparent Reporting

Generate detailed reports on disbursements by matter, client, or fee earner. Perfect for internal audits, financial analysis, and regulatory compliance.

Why Law Firms Choose Klyant for Disbursement Management

Designed for Legal Finance Teams

Klyant is not a general accounting solution — but is purpose-built for law firms. Our disbursement recording and billing processes are developed in close consultation with legal finance professionals to meet industry-specific challenges.

Full Compliance with SRA and Law Society Rules

Ensure your disbursement handling is compliant with relevant regulations in England, Scotland, Wales, Northern Ireland, and the Republic of Ireland — including VAT treatment, client money rules, and audit requirements.

Integrated with Your Legal Accounting

Disbursement management is just part of Klyant’s end-to-end legal accounting solution, including client accounting, office accounting, bank reconciliation, VAT submissions (MTD-compliant), and more.

Who Benefits from Klyant Software?

- Legal Finance Managers – Gain full visibility and control over disbursement flows.

- Solicitors & Fee Earners – Ensure all client expenses are recorded and recovered.

- Compliance Officers – Maintain peace of mind with audit-ready reports.

- Managing Partners – Make data-driven decisions to increase profitability.

See Klyant in Action

Ready to simplify disbursement management and improve your firm’s financial performance? Book a demonstration today and see how Klyant can help you stay compliant, bill accurately, and save time.

- What is disbursement management?

Disbursement management helps law firms track and recover expenses incurred on behalf of clients. It ensures these costs are properly allocated, billed, and reported, all while staying compliant with relevant legal accounting rules.

- Can I track disbursements without using the purchase ledger?

Yes, record disbursements directly from the matter itself with the option of linking directly to a supplier. Choose between VAT-inclusive or non-VAT disbursement types based on expense nature and jurisdictional requirements.

- Is Klyant compliant with legal accounting standards?

Absolutely. Klyant is fully compliant with the SRA Accounts Rules and Law Society of Ireland.