Law Office Accounting Software for Solicitors & Legal Professionals

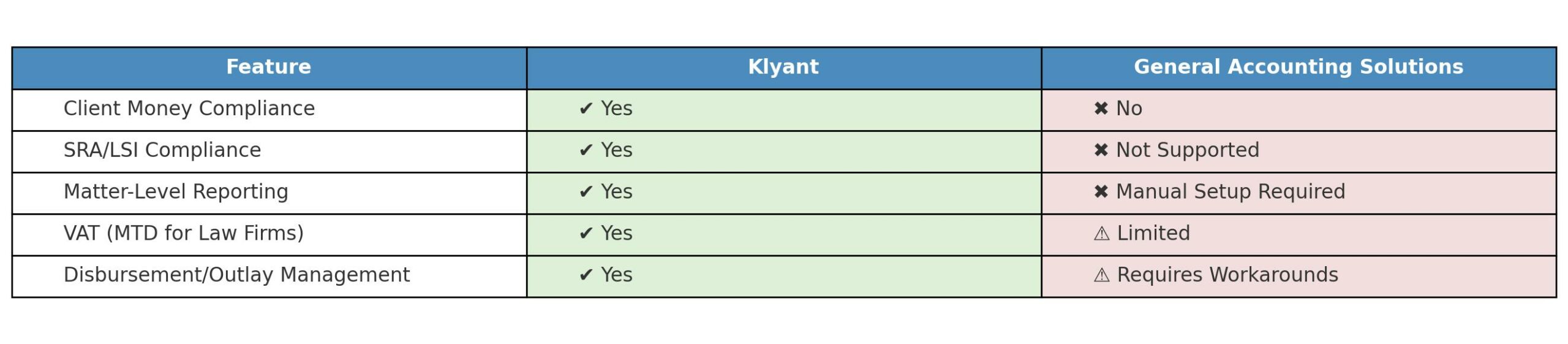

Running a law firm demands more than excellent legal work — it requires financial precision, compliance with industry regulations, and seamless operational efficiency. Klyant’s law office accounting software is designed specifically for solicitors, barristers, and legal finance professionals who need full control over firm finances, client money, and reporting obligations.

Klyant is not just another generic accounting system. It’s a purpose-built platform that understands the unique financial and regulatory requirements of law firms — from client accounts to SRA compliance and everything in between.

Modern Accounting for Modern Law Firms

What Is Law Office Accounting Software?

Law office accounting software helps legal practices manage both their operational finances and client money in full compliance with professional regulations. It handles:

- Office accounting (income, expenses, suppliers invoices & payments)

- Client accounting (Client account specific functionality)

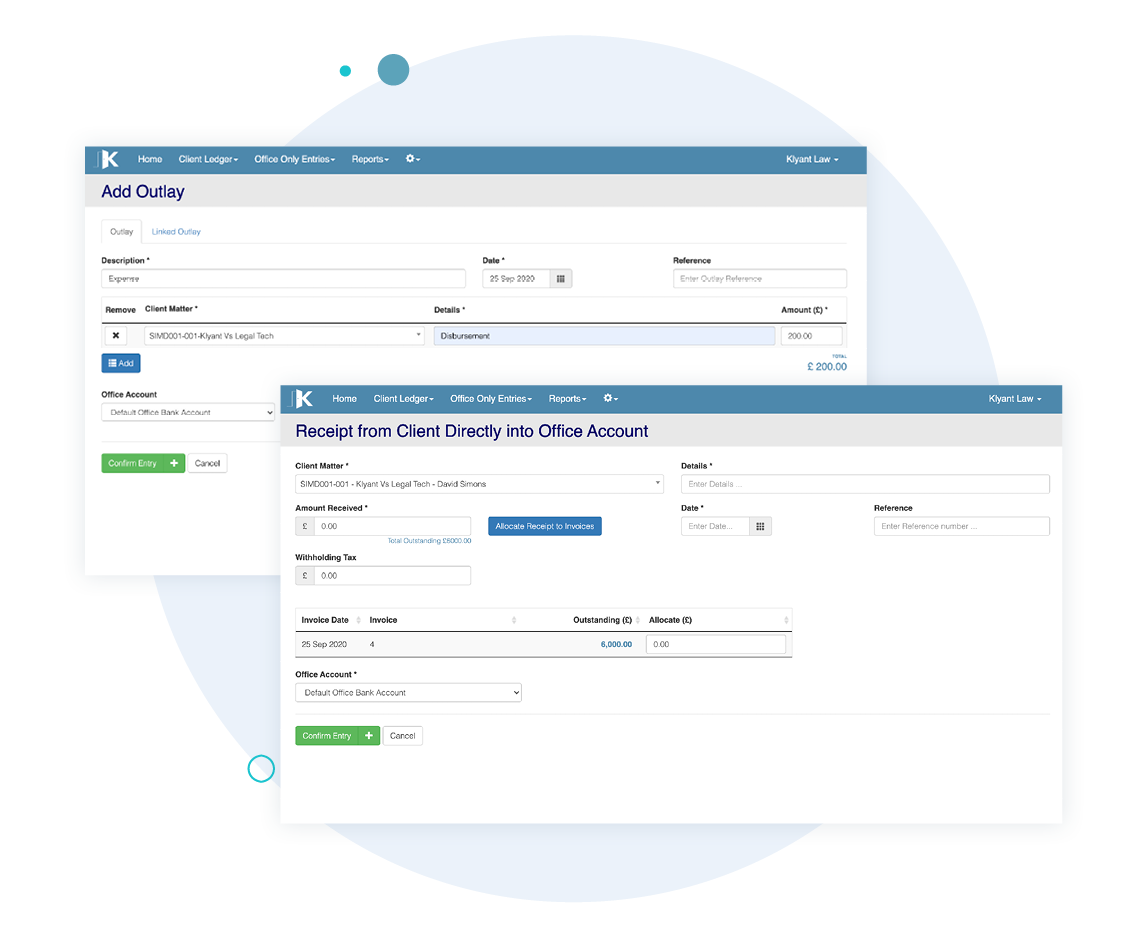

- Outlay/Disbursement management

- VAT reports and Making Tax Digital submissions

- Financial reporting tailored to law firms

Unlike standard bookkeeping tools, legal accounting software supports the split between office and client funds, ensures regulatory compliance, and supports legal-specific workflows and audit trails.

Core Features of Klyant’s Law Office Accounting Software

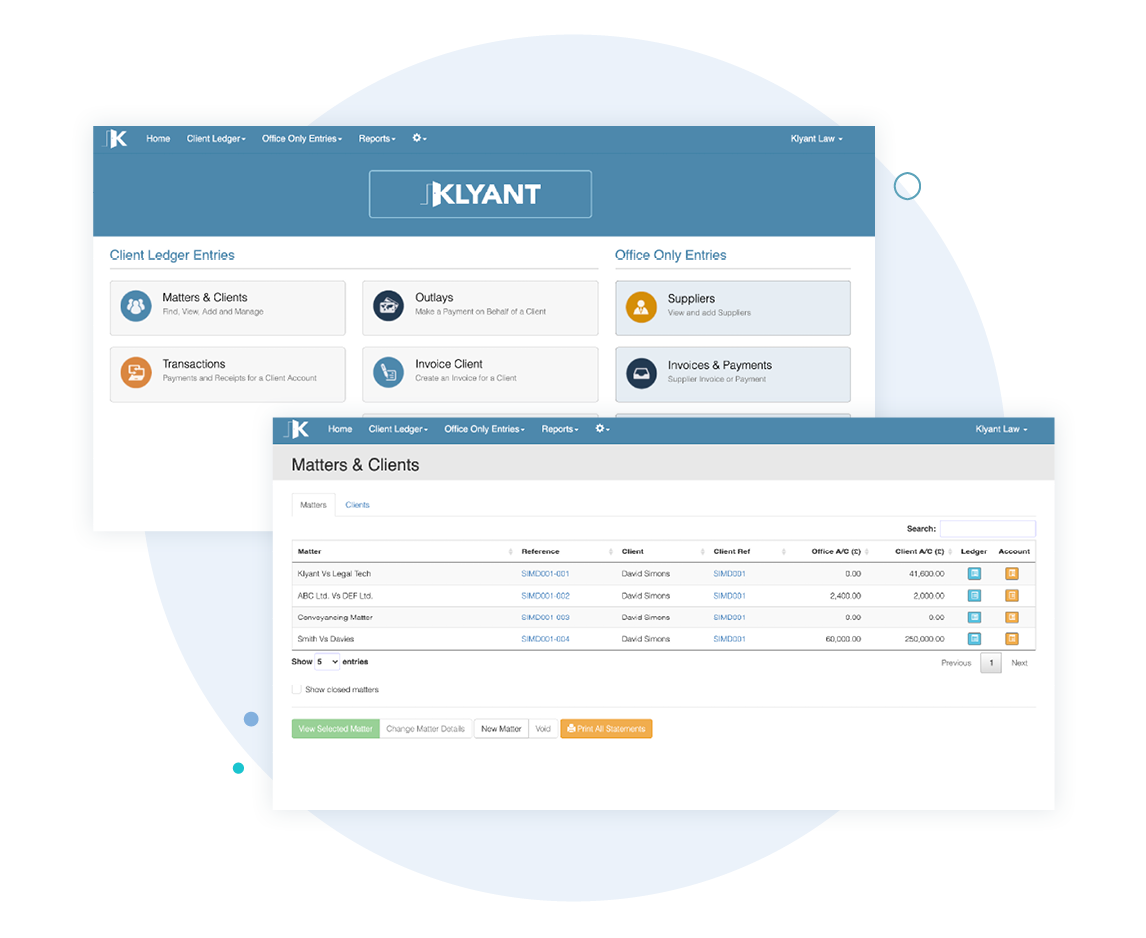

Legal Industry Specific Accounting: Office & Client Separation

Easily manage both office and client accounts in parallel. Klyant ensures that client money is never co-mingled with firm funds, supporting full compliance with:

- SRA Accounts Rules (England & Wales)

- Law Society of Ireland accounting standards

Advanced Reporting Tailored to Law Firms

Klyant includes 40+ built-in reports — all relevant to law firm operations:

- Fee earner performance

- Aged debtors and creditors

- Client account summaries (Change to Interactive Client ledgers)

- Management reports

- Client balance and activity reports

- Purchase ledger reports

- Nominal account reports

- Compliance reporting

- Reconciliation (bank) reports

- Performance reports

- VAT reports

- Dormant balances and overdrawn client ledgers

Export in PDF or Excel with pre-set filters. All reports are audit-ready.

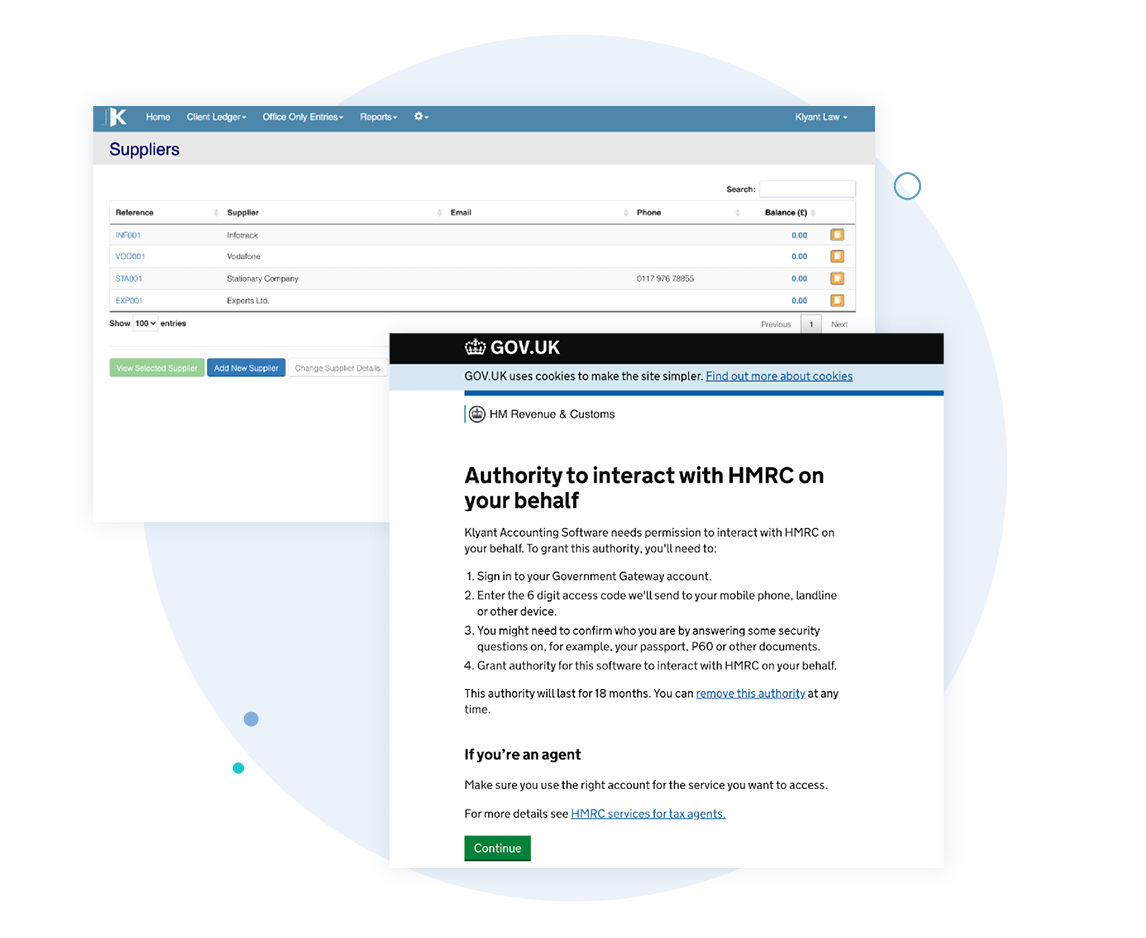

VAT & Making Tax Digital (MTD)

Enables UK firms to submit VAT returns directly to HMRC from within Klyant. The system pre-populates the HMRC portal with your VAT liability based on the data entered into Klyant.

Key Benefits for Law Firms

✅ Full Regulatory Compliance

Meet your professional obligations with built-in rules and safeguards that align with:

- Solicitors Regulation Authority (SRA)

- Law Society of Ireland

- Law Society of Northern Ireland

- Revenue Commissioners & HMRC (including MTD)

✅ Designed for Legal Workflows

Klyant was designed meticulously around the workflow of legal professionals — each transaction is linked directly to a client or matter, enabling crystal-clear audits and accurate financial control.

✅ Cloud-Based Technology

Access Klyant from anywhere, on any device with role based permissions to suit every users workflow and access rights

✅ Scalable for Firms of All Sizes

Whether you’re a sole practitioner, boutique firm, or a larger multi-office practice, Klyant scales with your needs. Add multiple users, and adapt workflows to suit your growing business.

Who Is Klyant For?

Klyant is trusted by a wide range of legal professionals, including:

- Managing Partners – for strategic financial oversight

- CFOs and Finance Managers – for operational control and reporting

- COFAs and Compliance Officers – for meeting regulatory obligations

- Legal Bookkeepers – for day-to-day accounting and bank reconciliation

- Fee Earners and Practice Managers – for performance tracking and matter analysis

Integrate with the Tools You Already Use

Klyant integrates with:

- Practice management systems

- HMRC for VAT submission

- Document Management Solutions

Get Started with Klyant Today

Join hundreds of law firms across the UK and Ireland already using Klyant to manage their firm’s finances more efficiently, accurately, and compliantly.

- Is Klyant suitable for small or solo law firms?

Yes. Klyant is designed to scale from sole practitioners to mid-sized and multi-office practices. Flexible pricing and setup options are available.

- Can Klyant help with client money rules?

Absolutely. Our software is built to comply with the strict regulations for the handling of client money.

- Does Klyant work for both UK and Irish law firms?

Yes. Klyant supports firms operating under SRA, Law Society of Ireland, and Northern Ireland regulatory frameworks — including full support for Making Tax Digital.