Law Firm Accounting and Financial Management Software

Law firm finance is not just about tracking income and expenses. It’s about ensuring regulatory compliance, managing client funds, reporting with precision, and supporting strategic decisions that drive profitability. Klyant’s law firm accounting and financial management software brings all these elements together in one cloud-based platform — tailored specifically to the legal sector.

From managing office and client accounts to generating SRA-compliant reports and fee earner performance metrics, Klyant empowers legal professionals to manage finances with confidence, clarity, and control.

Legal Accounting Software That Does More Than Just Balance the Books

What Is Law Firm Accounting and Financial Management Software?

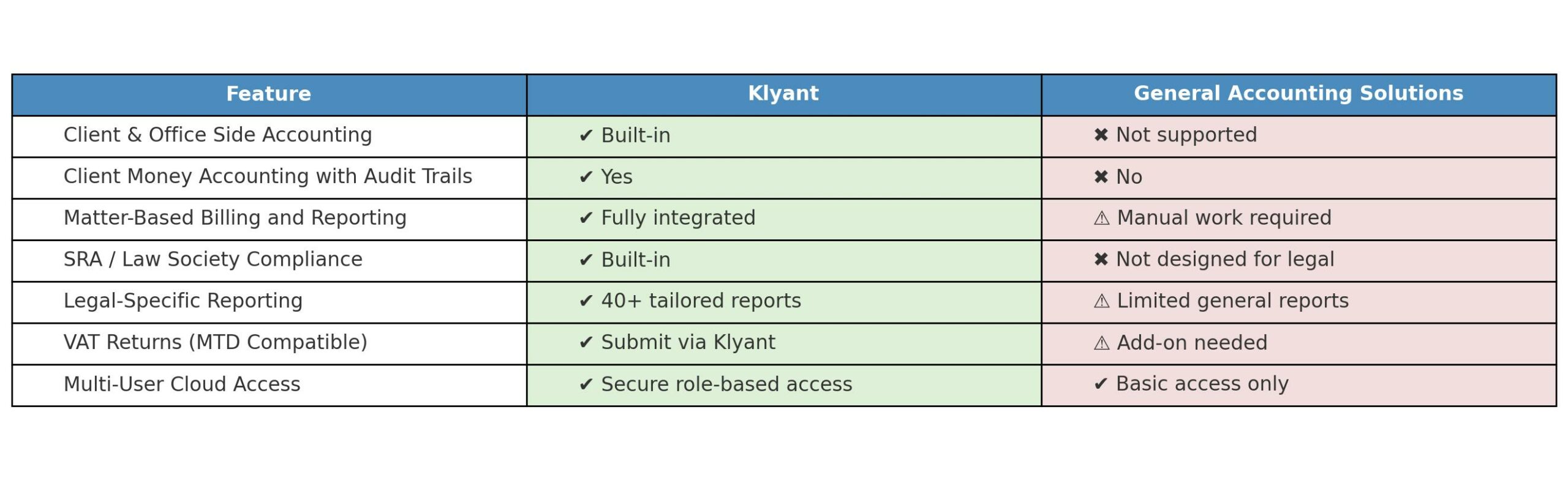

This category of software is designed specifically to address the financial and regulatory complexities of legal practices. Unlike generic accounting tools, it provides functionality to:

- Manage client and office money transactions simultaneously

- Produce a full set of financial reports across office and client account transactions

- Integrate billing and time recording with accounts

- Meet obligations under SRA, Law Society, and MTD rules

- Provide real-time insight into firm-wide profitability and performance

Klyant is one of the few platforms built from the ground up for legal finance teams — combining legal billing, reporting, and full financial management in one integrated system.

Complete Financial Management, Purpose-Built for Law Firms

Legal-Specific Accounting:

- Client and Office Ledger: Keep client and office money transactions fully segregated with smart client and office ledgers

- Streamlined Reconciliation: Easily and efficiently reconcile both office and client bank accounts

- Client Money Controls: Safeguard client funds with comprehensive ledgers, tailored reports for client-side transactions, and automated alerts to prevent client accounts from becoming overdrawn.

- Legal Specific Terminology: As Klyant is designed for law firms it uses terminology specific to the legal industry

End-to-End Legal Billing & Revenue Recovery

- Time Recording: Log time entries at matter level by fee earner

- Flexible Billing Models: Bill by the hour, fixed fees and discount rates

- Linked Disbursement/Outlay Capture: Link supplier invoices such as, court fees and search charges to specific Matters

- eChit Functionality: transaction submission and approval process

- Combined Receipts: Lodge multiple receipts across different matters

Real-Time Financial Management

- Aged Debtors & Creditors Reports: Speed up collections and manage supplier exposure

- Budgeting Tools: Assign fee and expense budgets to Matters

- Full suite of Financial Reports: Klyant includes management, regulation and performance reports

Who Uses Klyant?

Whether you’re a solo practitioner or a multi-branch firm, Klyant supports your financial operations from the ground up:

- Managing Partners – for profitability oversight and strategic insight

- CFOs / Finance Managers – for controlling firm-wide financial operations

- COFAs and Compliance Officers – for meeting regulatory requirements

- Legal Bookkeepers & Cashiers – for efficient, day-to-day financial processing

- Practice Managers – for operations and staff billing oversight

- Fee Earners – for simple time recording and matter visibility

Compliant with Legal Accounting Standards

Klyant ensures peace of mind for law firms operating in the UK and Ireland. Built-in safeguards and automation help you remain compliant without the admin burden.

Key Benefits of Klyant’s Accounting & Financial Software

Ready to Simplify and Strengthen Your Law Firm’s Finances?

Klyant helps law firms take back control of their finances — combining billing, accounting, reconciliation, and compliance into one easy-to-use platform.

Book Your Free Demo

Explore All Features

- Is Klyant suitable for small firms and solo practitioners?

Yes. Klyant is highly scalable — from one user to large multi-office teams. Pricing and functionality scale with your needs.

- Can I handle client money with Klyant?

Absolutely. Klyant is designed to manage client money transactions with full compliance and audit trails.

- Is the system MTD-ready for VAT?

Yes. UK firms can submit VAT returns directly to HMRC through Klyant in line with Making Tax Digital regulations.